PAN full form: Permanent Account Number

PAN Full Form

In a world driven by financial transactions and economic activities, the acronyms that define our financial identity hold immense importance. The acronym PAN, a unique identifier in the realm of taxation and finance, plays a vital role in facilitating transparent and accountable financial operations. The full form of PAN is “Permanent Account Number.” In this article, we will delve into the PAN full form, understand its significance in the financial landscape, and explore how it empowers individuals and organizations in their financial endeavors.

Deciphering the Full Form: Permanent Account Number

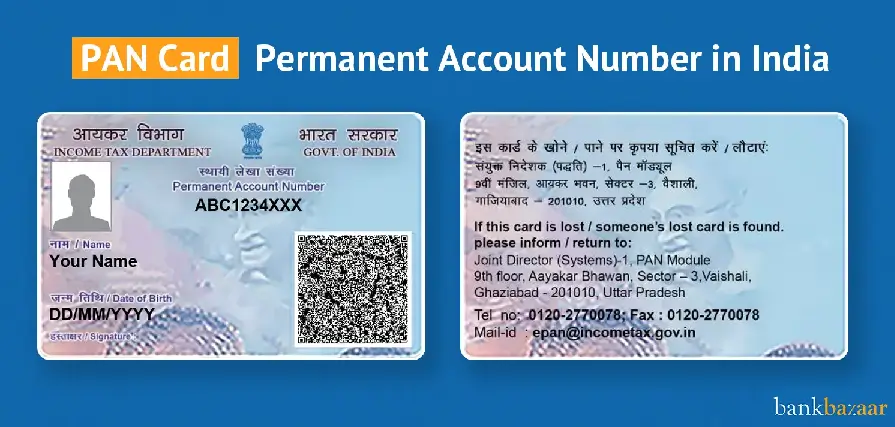

The acronym PAN stands for “Permanent Account Number.” A Permanent Account Number is a unique, alphanumeric identifier assigned by the tax authorities to individuals, businesses, and entities engaged in financial transactions.

The PAN’s Role in Financial Identification

In a complex financial ecosystem, the PAN acts as a keystone, providing accurate and reliable identification of taxpayers and facilitating seamless interactions between individuals, businesses, and government bodies:

- Uniqueness: Each PAN is unique, preventing confusion and ensuring accurate identification.

- Universal Application: PAN is used for various financial activities, including tax filing, opening bank accounts, and investment transactions.

- Tax Compliance: PAN ensures tax compliance, reducing the risk of tax evasion and promoting financial transparency.

- Cross-Referencing: PAN enables cross-referencing of financial information, aiding in tracking and verification.

Key Features of a PAN

- Alphanumeric Structure: PANs are composed of a combination of letters and numbers, making them distinct and recognizable.

- Validity: A PAN is valid for a lifetime and does not change even if an individual or entity relocates.

- Issuing Authority: PANs are issued by the Income Tax Department or authorized agencies in different countries.

- Online Verification: Many tax authorities offer online verification of PAN details, enhancing transparency and credibility.

PAN Applications and Use Cases

- Income Tax Filing: PAN is essential for filing income tax returns and claiming tax refunds.

- Financial Transactions: PAN is required for large financial transactions, property purchases, and investment activities.

- Banking: PAN is mandatory for opening bank accounts, including savings and fixed deposit accounts.

- Credit Transactions: PAN is used for credit card applications and loan processes.

PAN and the Digital Transformation

- Online Filing:

- E-filing of income tax returns and online PAN applications have simplified processes for taxpayers.

- Linkage to Aadhaar:

- In some countries, PAN is linked to biometric identification, enhancing accuracy and reducing duplication.

Future Trends and Developments

- Digital Wallet Integration:

- PAN integration with digital payment platforms may streamline financial transactions further.

- Enhanced Security:

- Efforts to enhance PAN security, such as biometric authentication, may be explored.

Conclusion

The PAN full form – Permanent Account Number – embodies a critical element in the financial fabric of our societies. From ensuring tax compliance to enabling seamless financial interactions, PAN empowers individuals and entities to participate actively in economic activities while upholding transparency and accountability. As technology continues to shape the financial landscape, the role of PAN in identifying and connecting taxpayers will remain integral, providing a foundation for responsible financial management and contributing to the growth and stability of economies worldwide.